The Connecticut real estate market continues to shift as we move into winter, and the latest November 2025 data offers a clear view of where things are heading. Home prices remain strong, buyer competition is cooling, and days on market are ticking up—signs of a market that is still healthy but increasingly balanced.

Below is a breakdown of the most important trends from the latest data and what they mean for homeowners, buyers, and sellers heading into 2026.

Home Prices Continue to Rise Despite Fewer Sales

While the number of homes sold has fallen, prices continue to move upward across Connecticut.

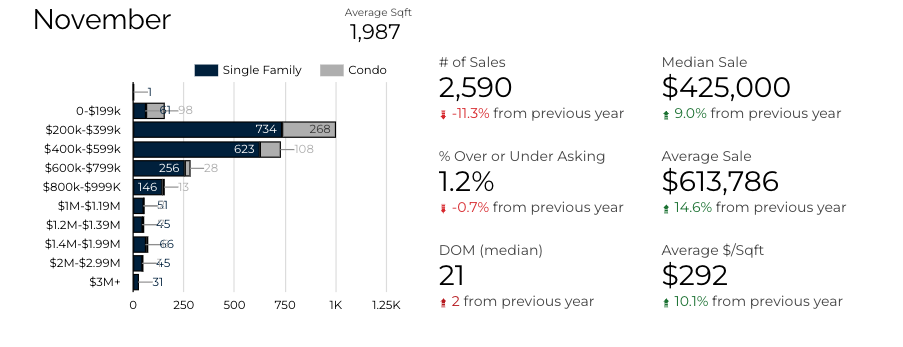

November 2025 Highlights:

Median Sale Price: $425,000 (up 9% year-over-year)

Average Sale Price: $613,786 (up 14.6%)

Average Price per Sqft: $292 (up 10.1%)

Number of Sales: 2,590 (down 11.3%)

This combination—rising prices and falling sales—reflects an environment where demand remains steady but inventory remains limited. Fewer homes on the market naturally lead to fewer sales, even while buyer interest stays active enough to keep prices appreciating.

Chart: November Snapshot

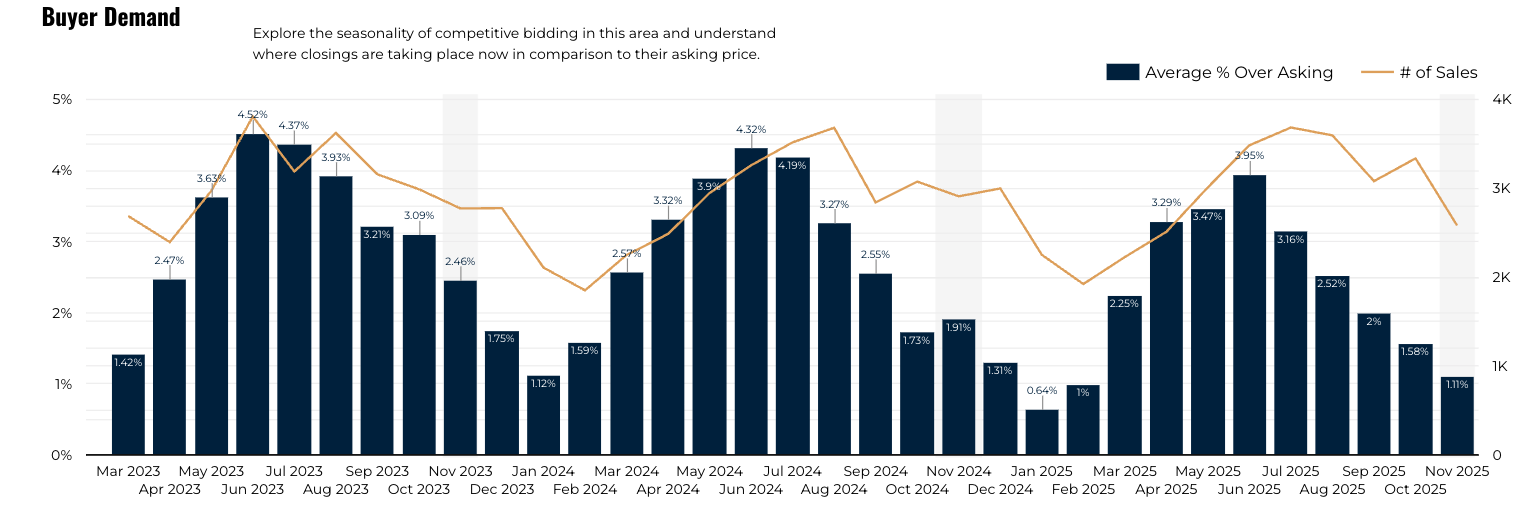

Buyer Demand Is Still Seasonal—And Winter Is the Least Competitive Window

If you’re a buyer, this is one of the most important charts to understand.

Competition peaks every year in late spring and early summer, when buyers consistently pay the largest premiums above asking price. As fall and winter arrive, bidding activity and showing volume decrease.

This year followed the same pattern:

Summer 2025 saw buyers paying 3–4% over asking on average

November 2025 dropped to 1.11% over asking

Showing activity per listing has also declined as the year ends

This seasonal cooling creates opportunities for buyers who prefer less competition and more negotiating power.

Chart: Buyer Demand (Average % Over Asking + Number of Sales)

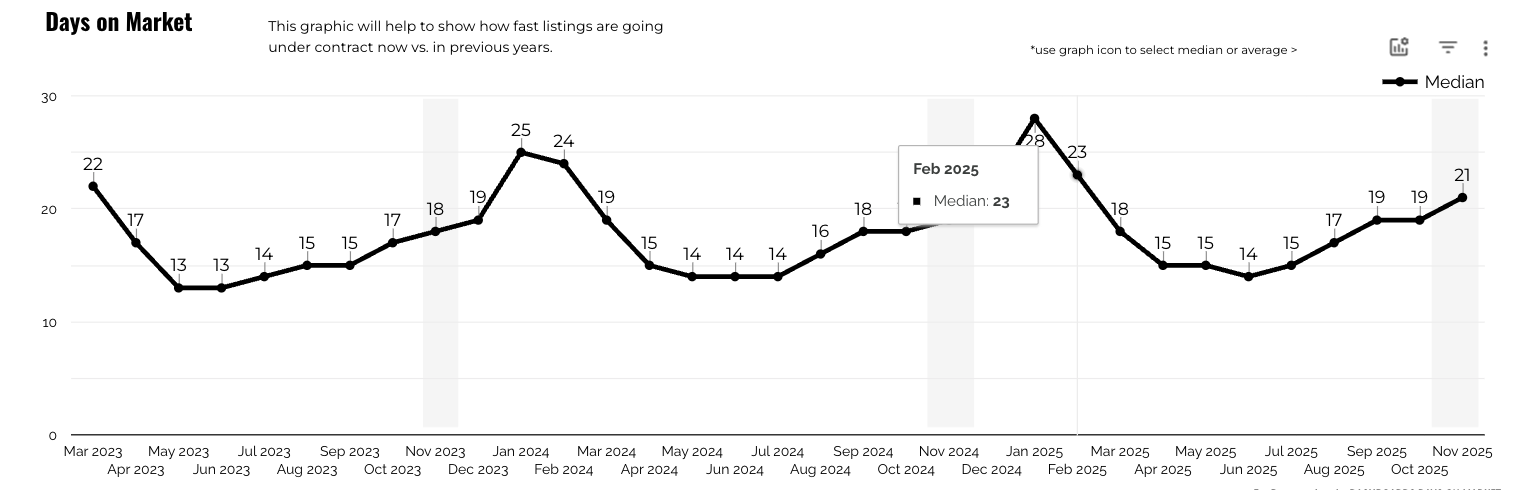

Days on Market Rising Into Winter—But Still Low Historically

The Days on Market (DOM) trend offers another clear picture of buyer activity.

DOM is lowest in spring and summer (around 14–16 days)

DOM increases through fall and winter (21–28 days)

November 2025 recorded 21 days on market, up from the summer lows

This increase is normal for the season—not a sign of weakening prices. Compared to pre-2020 norms, homes are still selling incredibly quickly.

For homeowners, this means properly priced homes continue to move.

For buyers, slightly longer DOM means less pressure to rush into decisions.

Chart: Days on Market Trend

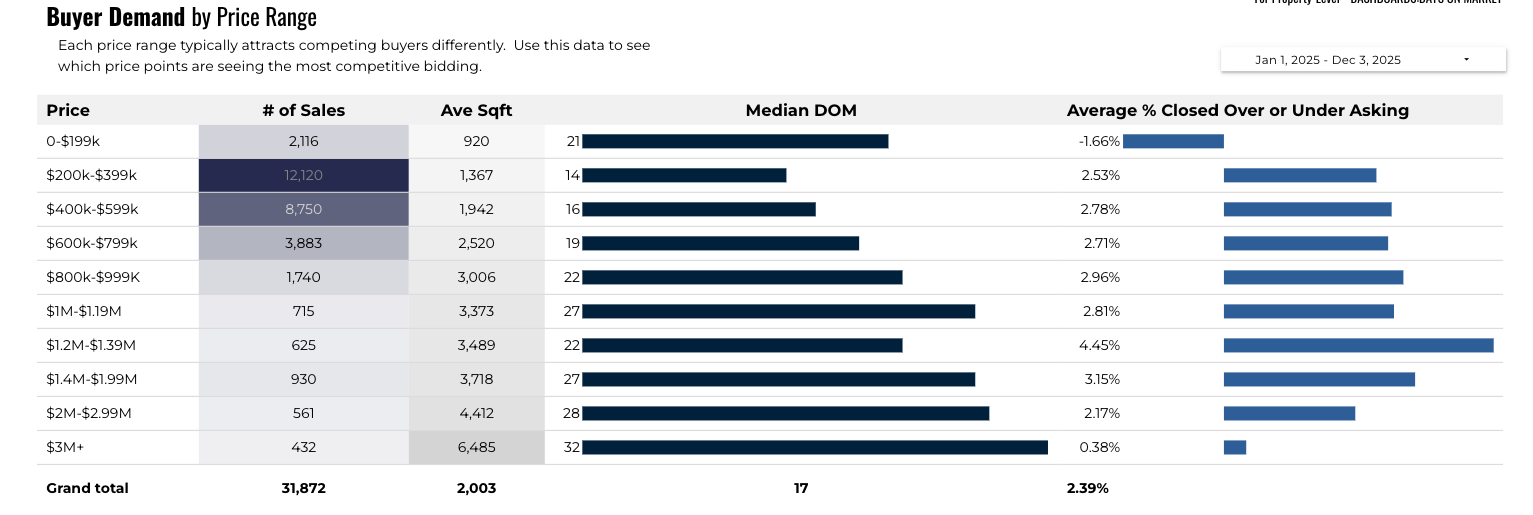

Which Price Ranges Are Most Competitive? A Look at Buyer Behavior by Segment

The “Buyer Demand by Price Range” data shows how different parts of the market behave—and where competition is strongest.

$200k–$399k Range

Most active price point with over 12,000 sales YTD

Median DOM: 14 days

Average % over asking: 2.53%

Very competitive, driven by first-time buyers and downsizers

$400k–$599k Range

Strong demand from move-up buyers

Median DOM: 16 days

% over asking: 2.78%

Still a highly competitive segment

$600k–$799k Range

Strong but more moderate demand

Median DOM: 19 days

% over asking: 2.71%

$1M–$1.39M Range

One of the strongest luxury segments

Buyers paid up to 4.45% over asking on average

Well-presented luxury homes attract serious offers

$2M+ and $3M+ Range

Longest days on market (28–32 days)

Minimal over-asking

A more selective buyer pool, typical of luxury markets

This breakdown allows buyers and sellers to set realistic expectations based on their price category.

Chart: Buyer Demand by Price Range

What This Means for Buyers and Sellers Heading Into 2026

For Buyers

Winter offers the best leverage of the year

Fewer bidding wars and more negotiating room

Days on market are higher—meaning more time to think and inspect

If you’ve been waiting for the market to cool slightly, this is your moment.

For Sellers

Prices are still rising and inventory remains tight

Properly priced homes continue to sell quickly

If you’re considering a spring listing, now is the time to prepare

Competition among buyers will return as we get closer to May–June

For Homeowners Staying Put

Your equity continues to grow

The market is stable, not declining

Local data still strongly favors long-term appreciation

Final Thoughts

The Connecticut housing market remains strong but is shifting into a more balanced pattern. Buyers are getting a bit more breathing room, sellers are still benefiting from rising prices, and both sides are heading into 2026 with better predictability and healthier conditions.

If you'd like a breakdown of how these trends impact your specific town—or if you want to know what your home might be worth right now—I’m always happy to help.