If you’re a homeowner in Marlborough, Connecticut, it’s natural to wonder:

“What’s my home worth in today’s market?”

“What’s my home worth in today’s market?”

Whether you’re planning to sell soon, refinance, or just keep tabs on your investment, knowing your current home value is the first step to making smart real estate decisions.

Why Marlborough, CT Homes Are in Demand

Marlborough continues to attract buyers thanks to:

Lake Terramuggus and recreational amenities

A balance of rural charm and convenient access to Hartford, Glastonbury, and Colchester

Top-rated schools and a family-friendly community

Larger lots, updated single-family homes, and a mix of new construction and classic colonials

These features keep demand strong and support steady price appreciation.

How to Find Out What Your Marlborough Home Is Worth

There are three main ways to get an idea of your home’s value:

1. Online Home Value Tools

Sites like Zillow or Redfin can give a quick ballpark estimate, but they can’t factor in your updates, condition, or the specific appeal of a home in Marlborough.

2. Comparable Sales (Comps)

Looking at recent sales of similar homes in Marlborough provides a clearer picture. Factors include:

Square footage and style (colonial, ranch, cape)

Lot size and location near Lake Terramuggus or commuter routes

Age, updates, and condition of the home

3. Professional Market Analysis

The most reliable way to know what your home is worth is through a Comparative Market Analysis (CMA) prepared by a local Realtor who understands Marlborough’s market trends.

What Impacts Your Marlborough Home’s Value?

Buyers looking in Marlborough tend to prioritize:

Condition and updates (kitchens, bathrooms, systems)

Proximity to amenities like Lake Terramuggus and hiking trails

Commute times to Hartford or Middletown

Lot size, privacy, and neighborhood appeal

Market timing (spring and early summer typically bring the highest sale prices)

Recent Market Trends in Marlborough, CT

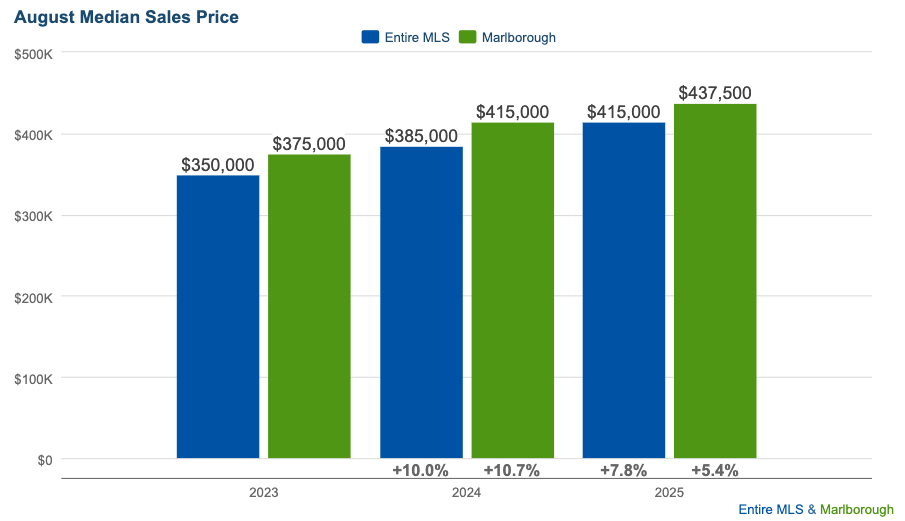

Here’s how Marlborough’s August median home prices compare to the statewide MLS over the past three years:

2023: Marlborough’s median sales price was $375,000, higher than the statewide $350,000.

2024: Prices climbed to $415,000, a 10.7% increase year-over-year, outpacing the statewide 10% gain.

2025: Marlborough continued rising to $437,500, another 5.4% increase, above the statewide $415,000.

This shows Marlborough homes are consistently outperforming the Connecticut average, making it a great time for homeowners to evaluate their equity.

Bottom Line: What’s My Home Worth in Marlborough, CT?

If you’re curious about your home’s current market value, the smartest move is to get a personalized home valuation. Online estimates are only rough guesses — a local expert can provide a precise number based on recent sales, your home’s condition, and today’s buyer demand in Marlborough.

Want to know what your home is worth? Contact me today for a free, no-obligation home value report and a customized selling strategy designed to maximize your equity.

Want to know what your home is worth? Contact me today for a free, no-obligation home value report and a customized selling strategy designed to maximize your equity.